BREAKING: New reports confirm that China’s global loan portfolio has skyrocketed to an astonishing $2.1 trillion, reshaping the international lending landscape. This alarming figure comes from a recent study by Virginia-based research institute AidData, revealing that China is now the world’s largest creditor, significantly outpacing its American counterparts in crucial areas of influence.

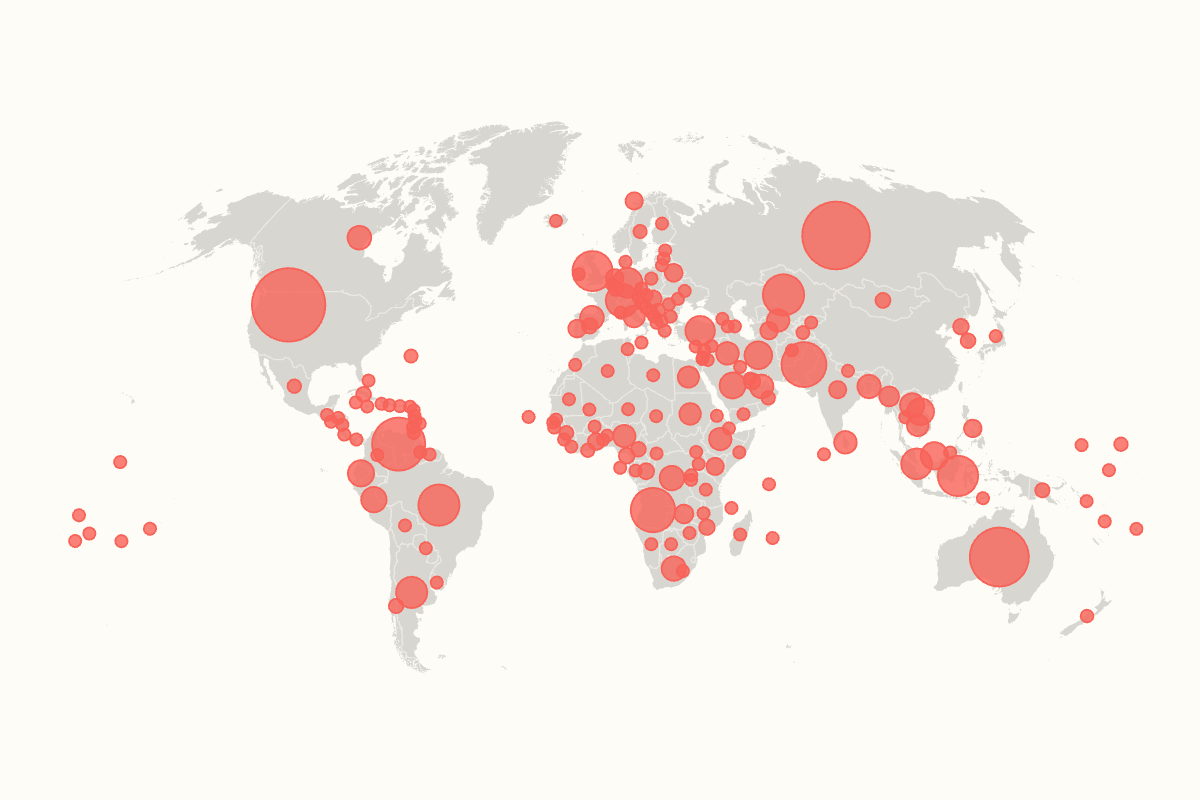

The report, which compiled data from over 30,000 projects across 217 countries, challenges previous estimates and assumptions about Chinese lending practices. It shows that high- and upper-middle-income nations account for a staggering 76 percent of these loans, indicating a shift from Beijing’s purported focus on developing nations.

Among the top recipients, the United States emerges as the largest, with $202 billion in loans linked to Chinese state entities spread across 2,500 projects nationwide. Following closely is Russia, receiving $172 billion, and Australia, with $130 billion. Other notable recipients include Venezuela and Pakistan, at $105.7 billion and $75.6 billion respectively, while the United Kingdom rounds out the top ten with its own significant debts.

Critics have labeled these loans as “debt-trap diplomacy,” suggesting that they lead to financial distress for borrowing countries due to high repayment demands. However, Chinese officials firmly reject this narrative, asserting that their lending practices are based on mutually beneficial agreements rather than coercive tactics.

Brad Parks, executive director of AidData, emphasized the implications of these findings: “This is an extraordinary discovery given that the U.S. has spent the better part of the last decade warning other countries of the dangers of accumulating significant debt exposure to China.” Meanwhile, Yang Baorong, director of African Studies at the Chinese Academy of Social Sciences, stated that China’s financing is aimed at fostering self-reliance through infrastructure development rather than creating dependency.

The urgency of this situation cannot be overstated. As China expands its influence, traditional lenders such as the U.S., Germany, and Japan are being forced to reevaluate their credit and aid strategies to remain competitive. The authors of the AidData report have declared China a “new global pace-setter rewriting the rules and norms” of international aid and credit.

As the geopolitical landscape shifts dramatically, stakeholders must stay informed about the evolving dynamics of global lending. The ramifications of this development will be felt worldwide, making it a critical issue to monitor in the coming weeks.

This is a developing story, and updates will follow as more information becomes available.