The Fibonacci sequence and the golden ratio, both rooted in nature, are increasingly influencing financial analysis techniques. Investors and market analysts utilize these mathematical concepts to manage financial securities, revealing patterns that echo the natural world. This article delves into the mathematical foundations of the Fibonacci sequence and its applications in financial markets.

The Fibonacci sequence begins with the numbers 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89, and continues indefinitely, where each number is the sum of the two preceding ones. The ratios formed by these numbers approach the golden ratio, approximately valued at 1.618. This ratio is derived by dividing a number in the sequence by its immediate predecessor, converging towards 0.618 as the sequence progresses.

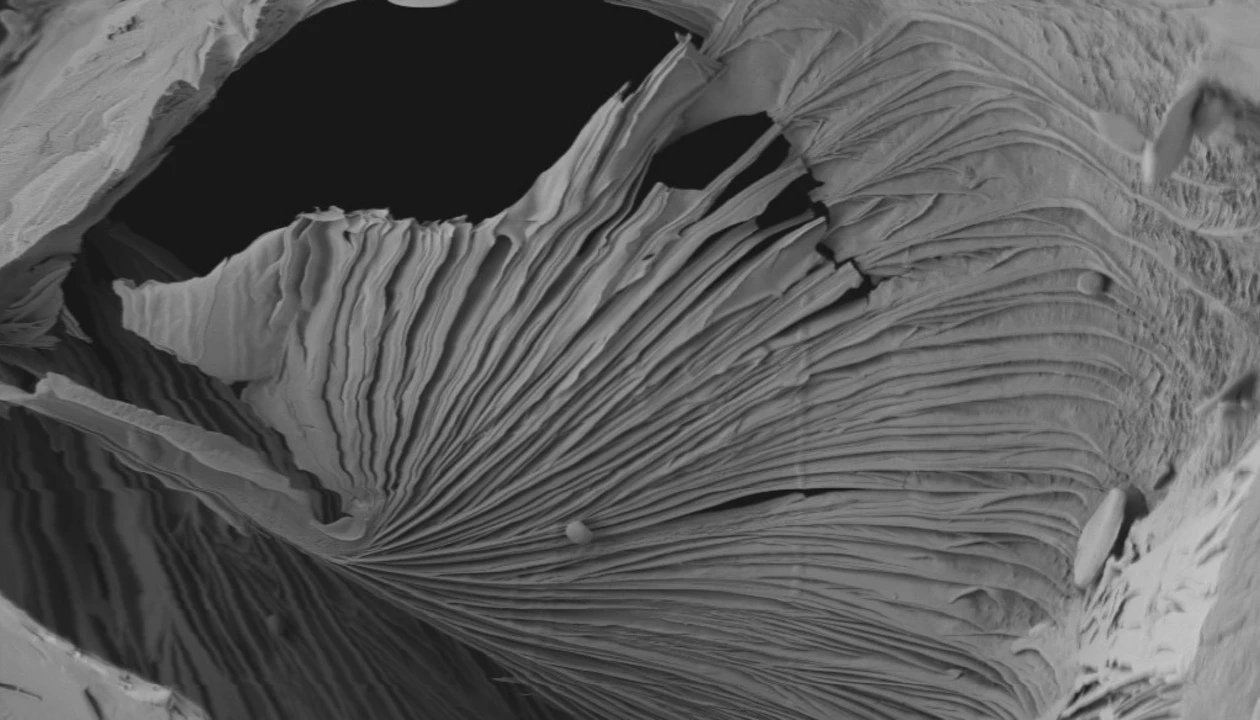

Understanding the Fibonacci sequence’s role in nature helps clarify its significance in technical analysis. For instance, the spiral patterns found in nautilus shells and sunflower seed arrangements exemplify this mathematical phenomenon. Spiral galaxies also exhibit arms that extend in accordance with the Fibonacci spiral, suggesting that these natural forms have inspired human interpretations of structure and proportion.

In art, the Fibonacci sequence has been used to achieve balance and harmony. Leonardo da Vinci’s Mona Lisa includes golden rectangles throughout, reflecting the golden ratio in her facial proportions. This connection between mathematics and aesthetics illustrates why the Fibonacci sequence resonates deeply within the human psyche, as our brains naturally seek and recognize patterns.

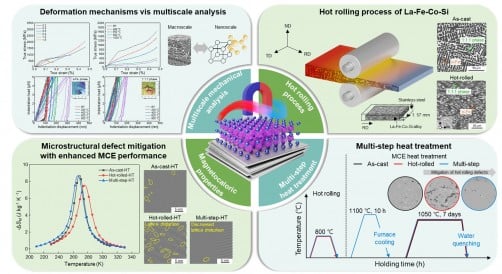

Market technicians leverage the Fibonacci sequence to identify potential support and resistance levels in financial trading. These levels are critical for making informed investment decisions. For example, when analyzing stock price movements, technicians may establish a range based on significant highs and lows, such as those recorded in early April 2025 and the peaks in October and December of the same year.

By applying the Fibonacci ratios to this established range, analysts can project support levels. The Fibonacci levels often cited include:

– 78.6%: This is derived from the square root of the golden ratio and is frequently used in analysis.

– 50%: Though not a Fibonacci retracement, this midpoint often serves as a psychological barrier in trading.

In this context, one might anticipate support at a price point of 640.34, with a subsequent level at 609.99, corresponding to the 61.8% Fibonacci level.

Fibonacci analysis also assists in determining potential resistance levels following a price increase. Market technicians apply the same ratios to assess future price movements, particularly when a bullish trend extends.

Despite the skepticism surrounding Fibonacci analysis, its application in financial markets is widespread, blending mathematical principles with human behavior and market dynamics. Critics may argue such techniques merely reflect a search for patterns, yet the enduring use of Fibonacci ratios demonstrates their significant impact on trading strategies.

Investors are reminded that trading in financial instruments, including cryptocurrencies, carries inherent risks. These can involve the potential loss of some or all invested capital. Therefore, it is essential to carefully assess individual investment goals and seek professional guidance if needed.

In conclusion, the Fibonacci sequence serves as a powerful technical analysis tool that harmonizes the principles of mathematics with the unpredictable nature of financial markets. As analysts continue to explore these timeless patterns, the links between nature, art, and finance will likely deepen, revealing further insights into market behavior.