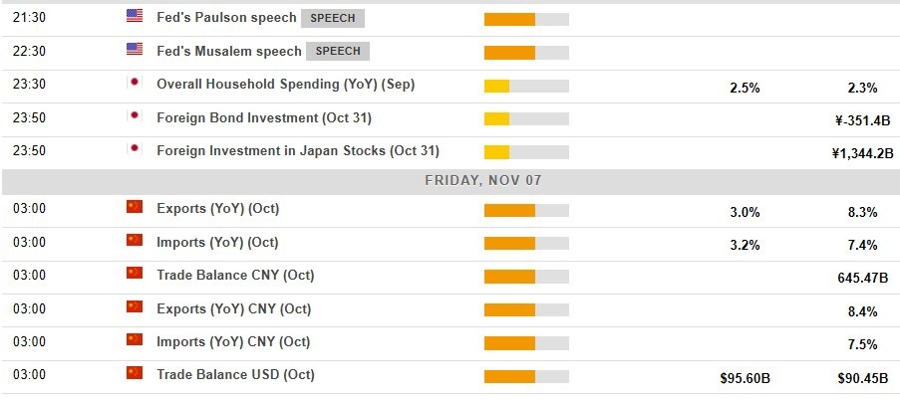

Economic data released on November 7, 2025, will provide important insights into China’s trade performance for October. The country is expected to report figures showing both exports and imports growing, albeit at a slower pace compared to September. The anticipated data will be released at 03:00 GMT, according to the National Bureau of Statistics of China.

Analysts predict that while growth remains positive, the rate of increase may reflect ongoing challenges in the global market. Factors such as supply chain disruptions and fluctuating demand may have contributed to the anticipated slowdown. Previous reports indicated an uptick in trade activity, but the upcoming figures are expected to temper expectations.

In addition to the Chinese trade data, several officials from the Federal Reserve are scheduled to speak later in the day. These addresses may provide further context on the U.S. monetary policy outlook and its potential impact on international trade dynamics. Market participants will be keenly observing these speeches, particularly in light of recent economic shifts.

The release of China’s trade data and Federal Reserve officials’ remarks could significantly influence investor sentiment. As economies worldwide continue to navigate uncertainties, these developments will be closely monitored by analysts and stakeholders alike. The outcomes may not only impact regional markets but also have broader implications for global economic stability.

Overall, November 7 promises to be a pivotal day for understanding the current state of international trade and monetary policy.