U.S. Bank has initiated a pilot program for stablecoin issuance on the Stellar network, marking a significant step in the evolving landscape of digital banking. The announcement was made during the U.S. Bank Money 20/20 podcast titled “The Tokenized Future of Banking.” While the bank has not disclosed specific details regarding the test’s scale or timing, it sees substantial potential in the digital asset space.

A representative for U.S. Bank stated, “We see a lot of opportunity in the digital asset and stablecoin space. And we plan to keep learning through various proof-of-technology tests and pilots that take different approaches.” This proactive stance reflects a broader trend among financial institutions exploring tokenized settlement systems.

Exploring the Stellar Network

In October 2023, U.S. Bank was appointed custodian for Anchorage Digital Bank’s stablecoin platform, responsible for safeguarding reserves of stablecoins launched through the platform. The bank is also contemplating the issuance of a proprietary stablecoin, either independently or in collaboration with partners. Notably, while many large U.S. banks are investigating the potential of stablecoins, none have yet launched their own.

According to a survey conducted by American Banker, only 2% of bank and credit union executives reported that their institutions were piloting a stablecoin. Meanwhile, 4% indicated plans to pilot or launch one, and 36% are in preliminary discussions about the idea without concrete plans.

Tiffani Montez, principal analyst for financial services at eMarketer, noted, “U.S. Bank could become the first major institution to issue a stablecoin.” She emphasized that the bank’s success will depend on its ability to safely scale within regulatory frameworks while ensuring that any new token complements its existing deposit funding model.

Key Features of Stellar

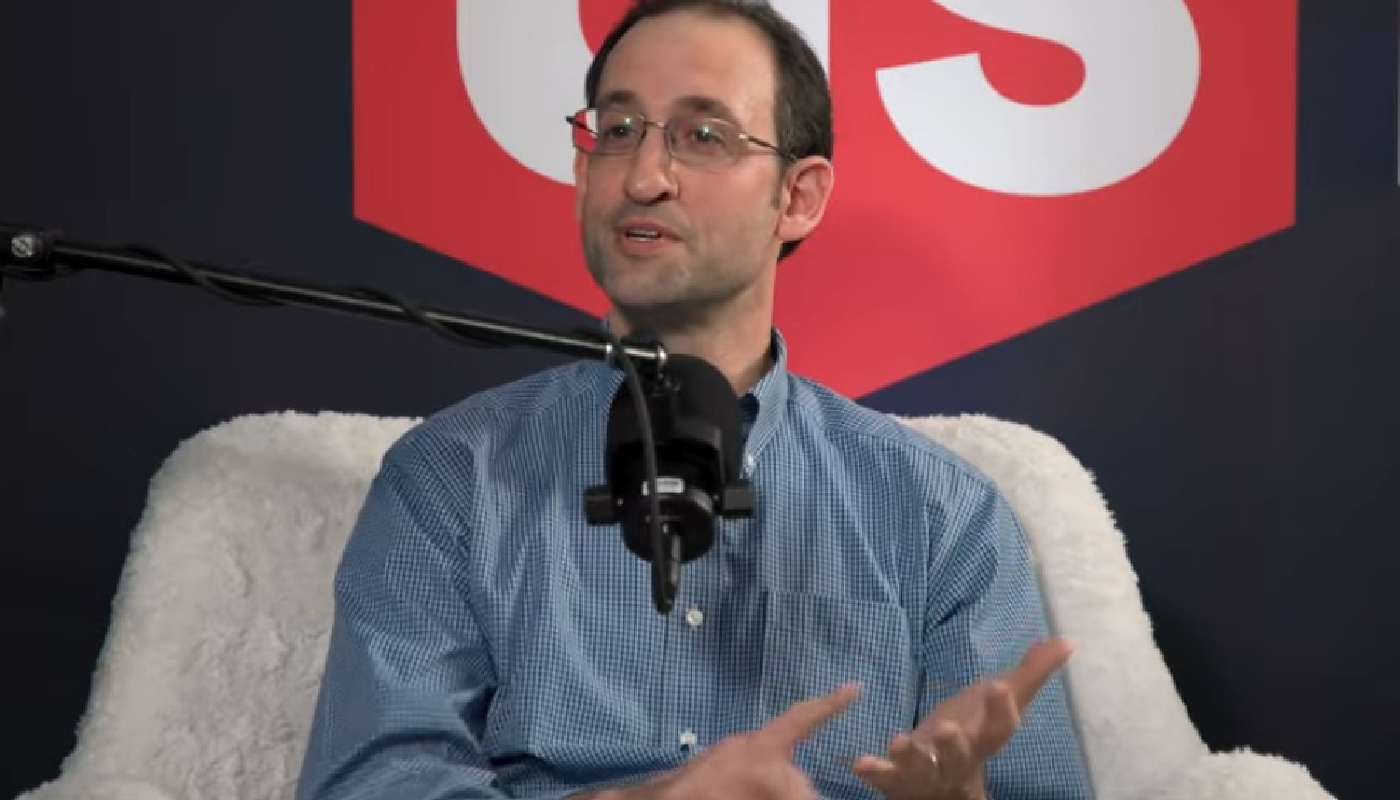

One of the primary reasons U.S. Bank chose the Stellar network is its capability to meet compliance requirements. Mike Villano, senior vice president of enterprise innovation at U.S. Bank, highlighted the advantages of stablecoins, stating, “Stablecoins are faster, cheaper, 24/7, and that’s true out of the box.” He pointed out the need for banks to incorporate additional protections, such as Know Your Customer (KYC) protocols and transaction recovery options.

Villano noted that the Stellar platform offers unique features, such as the ability to freeze assets and transactions directly at the blockchain layer. This capability is particularly appealing to financial institutions that must adhere to strict regulatory standards. José Fernández da Ponte, president and chief growth officer of the Stellar Development Foundation, explained that Stellar’s design was intentionally created with financial institutions in mind.

Unlike many decentralized networks where transaction validators may remain anonymous, the Stellar network requires validators to disclose their identities. This transparency is crucial for regulated entities that must know the identities of their business counterparts. Additionally, Stellar’s trust lines allow users to control which assets they receive, ensuring that they only engage with reputable issuers.

The Future of Stablecoins in Banking

The significance of U.S. Bank’s pilot extends beyond the institution itself. As the bank tests the mechanics of stablecoin issuance, reserves, and interoperability, it signals a potential shift towards institutional adoption of stablecoins. Montez remarked, “U.S. Bank’s pilot on Stellar signals that stablecoins are entering their institutional phase, with banks starting to evaluate how tokenized dollars could operate as real, regulated settlement infrastructure.”

As regulatory guidelines continue to evolve, the banks that act swiftly may shape how programmable, yield-bearing digital money integrates into core banking functions, including liquidity management and payment systems. With the capacity to support approximately 1,000 transactions per second, Stellar is positioned as a viable option for banks aiming to facilitate efficient digital transactions.

Currently, several crypto companies, such as Circle and PayPal, are utilizing the Stellar network to issue stablecoins. Other institutional players like BNY, Anchorage Digital Bank, and Cross River Bank are also developing infrastructure to support stablecoin issuance.

As U.S. Bank moves forward with its pilot program, the financial world will closely monitor its progress and the broader implications for the banking sector. The outcome of this initiative could redefine the role of stablecoins in traditional banking, paving the way for a more integrated and efficient financial ecosystem.