Retailers across the United States are grappling with a significant shortage of pennies, a situation that is forcing them to alter their cash handling practices. This shortage has arisen following a decision earlier this year by former President Donald Trump to cease penny production, which was becoming increasingly expensive due to rising manufacturing costs. The U.S. Mint’s final order for penny blanks was placed in May, and production officially stopped in August 2023.

The impact of this decision is now being felt at cash registers nationwide. According to Dylan Jeon, senior director of government relations with the National Retail Federation, retailers are losing as much as four cents on every cash transaction due to the inability to provide exact change. “It’s unsustainable,” Jeon stated in an interview with BBC News.

Retail Responses and Customer Adaptation

As the shortage persists, many retailers are implementing creative solutions to mitigate financial losses while maintaining customer satisfaction. For example, McDonald’s USA has informed customers that some locations may struggle to provide exact change in light of this crisis. The company is actively exploring long-term strategies to address the issue, acknowledging the widespread impact on all retailers.

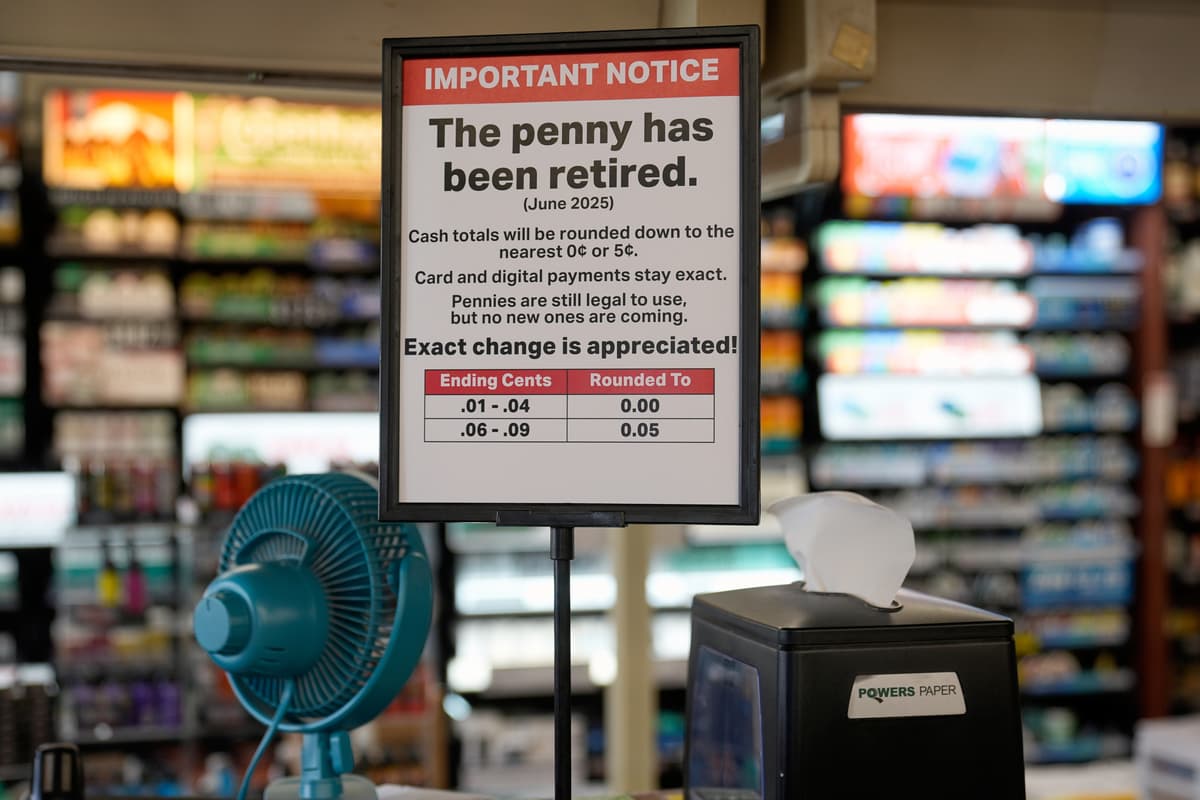

To adapt, Pennsylvania-based grocery chain Giant Eagle is hosting a promotional event where customers can receive two cents on a gift card for every penny they turn in. Similarly, Sheetz Convenience Stores is offering a free soda to customers who pay for purchases with a dollar’s worth of pennies. Other retailers are encouraging the use of credit or debit cards and rounding cash transactions to the nearest nickel.

In addition, banks are beginning to ration their limited supplies of pennies, prioritizing high-volume customers. This growing scarcity is prompting retailers and consumers alike to seek alternatives to cash transactions.

Lessons from Other Nations

Despite the current turmoil, historical precedents from other countries suggest that the risks associated with a penny shortage may be manageable. Countries such as Canada, Australia, Ireland, and New Zealand have successfully eliminated their one-cent coins without causing economic turmoil.

In Canada, the last penny was minted in 2012, leading to initial confusion at cash registers. However, residents quickly adapted by rounding cash transactions to the nearest nickel while maintaining the accuracy of electronic payments. More than a decade later, many Canadians have seemingly forgotten the existence of the penny, highlighting society’s capacity to adjust to changes in currency practices.

As the U.S. grapples with its own penny shortage, retailers and consumers may find that adaptation is not only possible but also necessary in the ever-evolving landscape of cash transactions.