Equities research analysts at Scotiabank have reduced their price target for Oracle Corporation (NYSE: ORCL) from $260.00 to $220.00. This adjustment, revealed in a report issued on December 19, 2023, maintains a “sector outperform” rating for the enterprise software provider. The new target suggests a potential upside of approximately 37.24% from the current trading price.

Several other financial institutions have also recently adjusted their views on Oracle. Piper Sandler lowered its target from $290.00 to $240.00, while maintaining an “overweight” rating. In contrast, Guggenheim reiterated a “buy” rating with a target price of $400.00. Weiss Ratings reduced its rating from “buy (b-)” to “hold (c+)”, and Deutsche Bank Aktiengesellschaft confirmed its “buy” rating with a target of $375.00. BMO Capital Markets also adjusted its forecast, decreasing its target from $355.00 to $270.00.

Analysts currently show a mixed sentiment towards the stock. Among them, three have issued a Strong Buy rating, twenty-five have assigned a Buy rating, eleven have recommended holding, and two have given a Sell rating. According to MarketBeat.com, Oracle has a consensus rating of “Moderate Buy” and a consensus target price of $297.89.

Recent Performance and Earnings Report

On December 10, 2023, Oracle released its quarterly earnings, reporting an earnings per share (EPS) of $2.26, surpassing analysts’ expectations of $1.64 by $0.62. The company achieved a net margin of 25.28% and a return on equity of 70.60%. Revenue for the quarter totaled $16.06 billion, slightly below the projected $16.19 billion. This represents a year-over-year revenue increase of 14.2%, compared to $1.47 EPS in the same period last year.

Industry experts predict that Oracle will report an EPS of $5 for the current fiscal year.

Insider Activity and Institutional Holdings

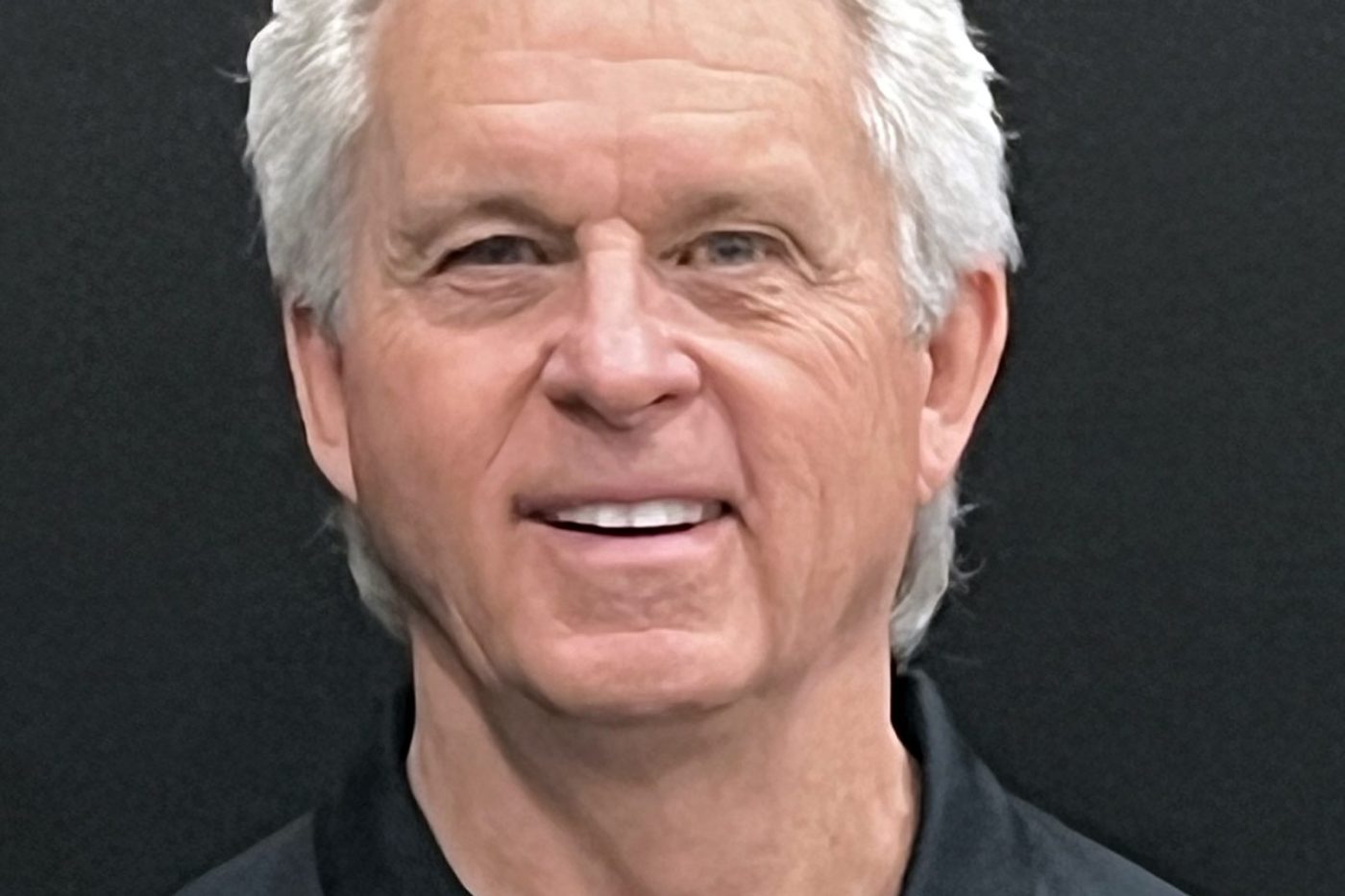

In corporate news, CEO Clayton M. Magouyrk sold 10,000 shares of Oracle stock on December 19, 2023, at an average price of $192.52, resulting in a total transaction of $1,925,200.00. After this sale, he retained 144,030 shares, valued at approximately $27,728,655.60, marking a decrease of 6.49% in his position.

Additionally, Douglas A. Kehring, Executive Vice President, sold 35,000 shares on January 15, 2024, at an average price of $194.89, totaling $6,821,150.00. This transaction led to a 50.99% reduction in his holdings, leaving him with 33,638 shares valued at about $6,555,709.82.

In recent months, insiders have collectively sold 62,223 shares worth $12,136,764. Currently, insiders hold 40.90% of Oracle’s stock.

Institutional investors have also been active. The Swiss National Bank increased its stake in Oracle by 7.6% in the second quarter, now owning 5,093,200 shares valued at approximately $1,113,526,000. Patton Fund Management Inc. significantly raised its position by 626.1% during the third quarter, acquiring an additional 9,948 shares.

In total, institutional investors and hedge funds hold 42.44% of Oracle’s stock, reflecting ongoing interest in the company amid market fluctuations.

Oracle Corporation continues to adapt within the competitive landscape of enterprise software, focusing on innovations in cloud computing and a diverse range of data management solutions. The company’s ongoing efforts in these areas are closely monitored by analysts and investors alike.