Indirect taxes play a crucial role in global commerce, influencing how businesses operate and how consumers pay for goods and services. Unlike direct taxes, which are deducted from income, indirect taxes are levied on the purchase of products and services. This means that when a consumer buys an item, they pay the tax, while businesses act as collectors, forwarding the funds to the government. For companies operating locally or internationally, understanding indirect taxes such as Value-Added Tax (VAT), Goods and Services Tax (GST), and Sales Tax is essential for compliance and financial management.

What Are Indirect Taxes?

At its core, an indirect tax is a consumption tax. The key points include:

– **The Burden is Shifted**: The seller collects the tax from the buyer, effectively making the buyer the one who pays it.

– **Based on Spending**: Taxes are applied when a sale occurs, making them a significant source of revenue for governments worldwide.

The structure of indirect taxes varies by country, but the principles remain consistent. The three primary types are:

1. **Value-Added Tax (VAT)**: Predominantly used in Europe, parts of Canada, and various other nations, VAT is applied at each stage of production. Businesses can reclaim VAT on their purchases, ensuring that only the final consumer bears the full tax burden.

2. **Goods and Services Tax (GST)**: Found in countries like Australia, India, and New Zealand, GST simplifies the tax system by unifying multiple taxes under a single framework.

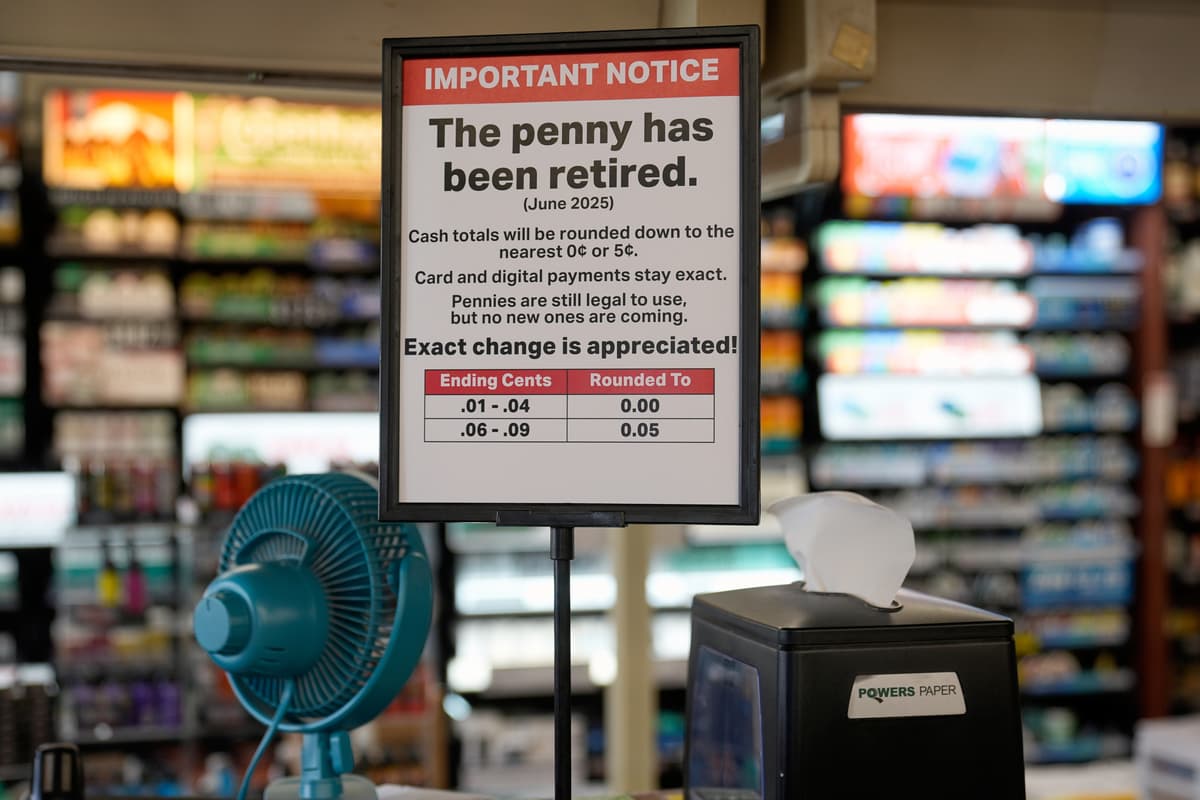

3. **Sales Tax**: Primarily in the United States, Sales Tax is collected at the point of sale. Unlike VAT or GST, it is not applied throughout the supply chain, which can lead to a complex landscape of rules varying by state and municipality.

Compliance Requirements for Businesses

Navigating indirect tax regulations is critical for businesses, as errors can result in severe penalties and reputational damage. Key compliance steps include:

1. **Registering Your Business**: Once sales exceed a specific threshold in a given country, businesses must register to collect the applicable tax. Operating without registration is a significant violation.

2. **Knowing When to Tax**: Businesses must determine the taxability of their products or services, which can vary by location and item classification. For example, essential goods like certain foods or healthcare services may be exempt from taxation.

3. **Applying the Correct Rate**: Tax rates can differ by product type and location, necessitating accurate tracking and application. In complex regions, businesses may require specialized software to manage these calculations.

4. **Maintaining Records**: Proper documentation is vital. Businesses should issue tax invoices detailing tax identification numbers, total prices, rates, and amounts collected, while also keeping comprehensive records of all transactions.

5. **Filing and Paying Taxes**: Regularly calculating net tax and filing the required forms on time is essential to avoid fines.

The rapid expansion of e-commerce has further complicated indirect tax compliance. In the United States, the **Economic Nexus** rule, established by the 2018 court ruling in *South Dakota v. Wayfair*, requires businesses to collect sales tax based on economic activity in a state, regardless of physical presence.

For digital services, international regulations typically use the **Destination Principle**, meaning services are taxed in the consumer’s location. This can impose additional responsibilities on businesses selling digital products, as they must register and comply with tax regulations in each customer’s country.

Indirect taxes significantly influence business strategy. Companies must consider how these taxes affect pricing, cash flow management, supply chain decisions, and mergers and acquisitions. Proper management of indirect tax can improve competitiveness and enhance financial stability.

As indirect tax regulations continue to evolve, especially in response to digital commerce, a proactive approach is essential. Businesses should regularly monitor sales thresholds across jurisdictions, invest in tax compliance technology, and consult with tax professionals to navigate complex international rules effectively.

By embedding indirect tax compliance into their operational strategies, companies can minimize risks, optimize cash flow, and lay a solid foundation for sustainable, global growth.