The Fibonacci sequence and the golden ratio are increasingly recognized as valuable tools in financial analysis, drawing inspiration from patterns found in nature. These mathematical principles are employed by market technicians to forecast price movements and identify trends in the financial markets.

Understanding Fibonacci and Its Applications

The Fibonacci sequence begins with the numbers 0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, and continues indefinitely. Each number in this series is the sum of the two preceding numbers. As this series progresses, the ratios of consecutive Fibonacci numbers approach the golden ratio, approximately 1.618. This ratio emerges when dividing a larger Fibonacci number by its immediate predecessor, resulting in a value that hovers around 0.618.

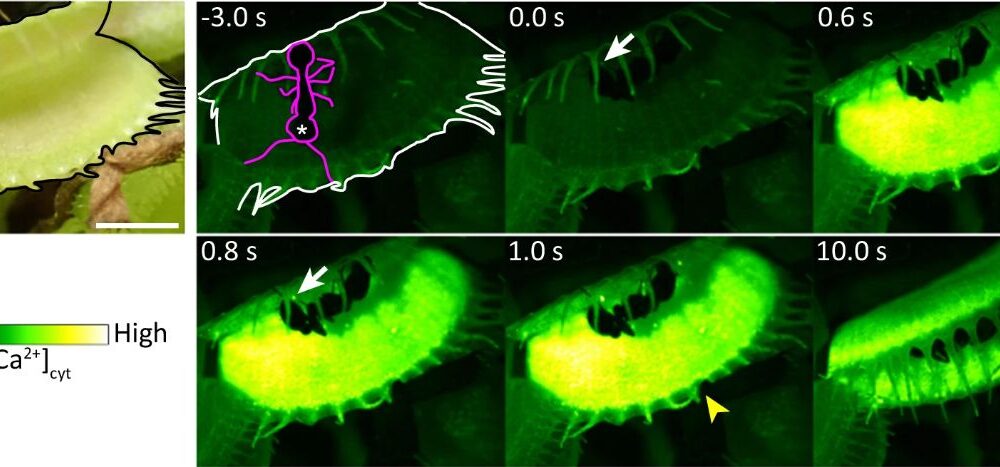

This mathematical framework extends beyond mere numbers; it is intricately linked to various natural phenomena. For instance, the spirals in nautilus shells and sunflowers exhibit proportions that align with the Fibonacci sequence. Additionally, spiral galaxies exhibit similar patterns, with arms extending in ways that echo Fibonacci spirals.

The golden ratio also appears in art, such as Leonardo da Vinci’s *Mona Lisa*, where rectangles can be drawn around key features, demonstrating the aesthetic appeal of these mathematical principles. These occurrences suggest that both mankind and nature have an innate affinity for these ratios, influencing everything from artistic composition to the functioning of the human brain.

Fibonacci in Financial Markets

In the realm of finance, Fibonacci analysis serves as a method for identifying potential support and resistance levels. Traders often utilize specific percentages derived from the Fibonacci sequence to gauge market movements. For example, a selected price range might start at the lows observed in early March 2025, with peaks established in October and December serving as endpoints.

The key Fibonacci levels to watch include:

– **78.6%**: While not part of the Fibonacci sequence, this level is commonly used in analysis due to its alignment with the square root of the golden ratio.

– **61.8%**: Known as the “golden rule,” this level often indicates significant support.

– **50%**: Though not a Fibonacci retracement, this midpoint is regarded as a psychological level that frequently influences trading decisions.

As traders analyze a chart, they look for these levels to determine where the price might pull back or encounter resistance. Fibonacci analysis can also project potential resistance after a new price high is reached, although it requires an estimation of where the trend may halt.

Despite some skepticism regarding its efficacy, the widespread use of Fibonacci analysis underscores its appeal as a fusion of mathematics, psychological behavior, and market dynamics. The ability to identify patterns that align with human perception can enhance traders’ decision-making processes.

Traders are encouraged to employ a combination of analytical techniques rather than relying solely on Fibonacci patterns. The more that various analyses converge on similar conclusions, the higher the likelihood of success.

As financial markets continue to evolve, the integration of Fibonacci principles remains a testament to the intersection of nature, mathematics, and economics. With its roots in the natural world, the Fibonacci sequence continues to provide insights into the complexities of financial analysis, offering a framework for traders navigating the ever-changing landscape of the markets.

Risk Disclosure: Trading in financial instruments and cryptocurrencies involves significant risks, including the potential loss of the entire investment. Investors should thoroughly assess their risk tolerance, investment objectives, and seek professional advice before engaging in trading activities.