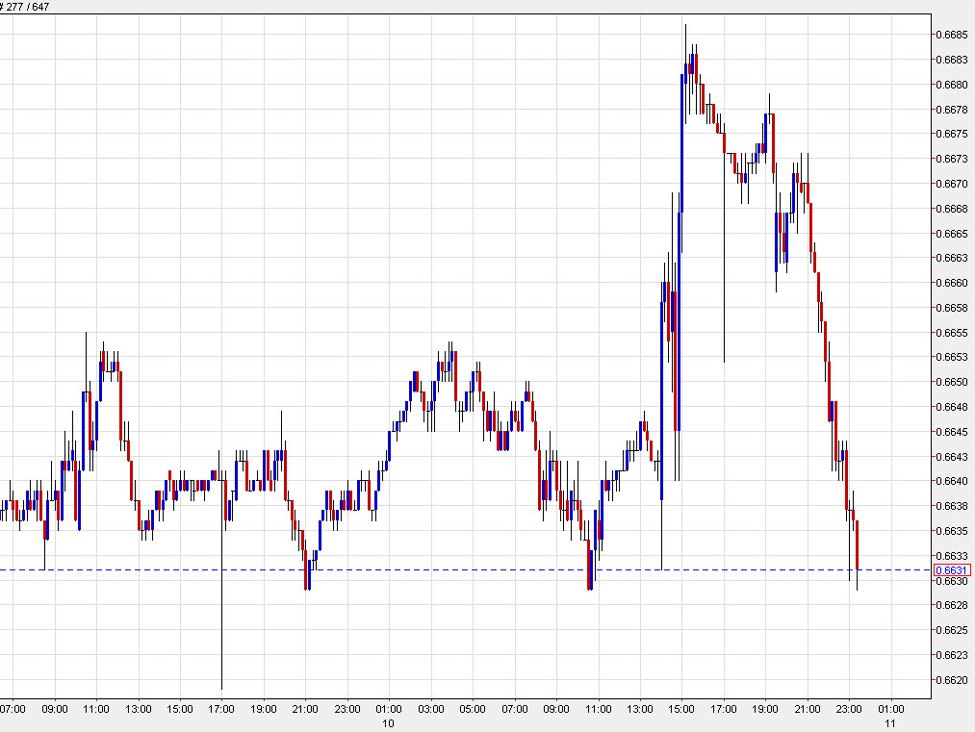

UPDATE: The Australian dollar (AUD) is facing significant declines in Asian trading today, following a swift unwinding of gains made post-Federal Reserve announcements. Just hours ago, AUD/USD rates dipped sharply as traders reacted to market pressures and profit-taking.

This downturn comes amidst a backdrop of profit-taking activities, particularly exacerbated by disappointing earnings from Oracle Corporation, which saw its shares plummet, impacting overall market sentiment.

The Federal Reserve’s recent decision to raise its GDP forecast for 2026 from 1.8% to 2.3% has stirred some optimism about global growth and its subsequent influence on Australian commodity exports. However, this positive note is dampened by ongoing struggles in Chinese stock markets, creating uncertainty about Australia’s economic outlook.

As of now, the sentiment in the market indicates a need for more substantial catalysts beyond the Fed’s latest moves to invigorate investor confidence. Traders and analysts suggest that significant shifts may not be realized until 2026.

The current market dynamics are critical, with many investors closely monitoring developments that could affect the AUD. The interplay of U.S. economic indicators, coupled with China’s performance, will be pivotal in shaping the trajectory of the Australian dollar in the coming weeks.

For now, all eyes are on upcoming economic reports that could provide further insights into these trends. The immediate future of the AUD remains uncertain, prompting traders to reassess their positions as the market evolves.