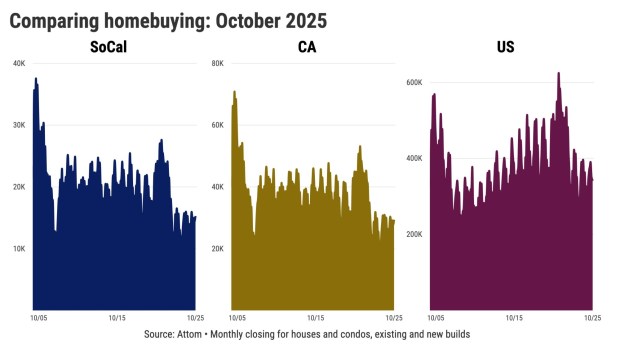

UPDATE: California home sales have dropped a staggering 22% below the average, marking the fourth slowest October in over two decades. According to real estate tracker Attom, only 29,379 homes and condos changed hands across the Golden State in October 2023, reflecting a 2.2% decline from last year.

The significant slowdown in home buying activity raises urgent questions about affordability and buyer sentiment in a state where the cost of living remains high. Despite a slight decline in mortgage rates, prospective buyers are hesitant to commit, influenced by ongoing economic instability and soaring housing prices.

In a year, California home sales totaled 324,475, a modest increase of 2%. However, this figure is still 26% below the 21-year average, indicating a troubling trend for the housing market.

The current median selling price for California homes stands at $735,125, a 0.5% decrease from the previous year but only 2% shy of the record high of $750,000 set in May 2024. Even as price appreciation cools, it hasn’t reignited buyer enthusiasm. Prices surged 9% over the past three years following a dramatic 35% increase during the pandemic, when low mortgage rates and demand for larger living spaces drove the market.

The Federal Reserve’s decision to raise interest rates in early 2022 aimed to combat inflation, which has now influenced borrowing costs. The average mortgage rate in California hit 6.4% for the three months ending in October, down from a peak of 7.4% in November 2023. However, this still translates to an average monthly mortgage payment of $4,597, which has surged 101% over the past six years.

For many potential buyers, the challenge lies in affordability. A typical buyer now needs to muster $147,025 for a 20% down payment, making homeownership feel increasingly out of reach for countless families.

As California grapples with these challenges, industry experts emphasize the need for solutions to bolster buyer confidence. With home prices still high and economic uncertainty looming, many are left wondering when the market will stabilize.

What’s next? Market watchers will be closely monitoring mortgage rates and economic indicators as we head into the new year. As buyers continue to hesitate, the ripple effects on the broader California economy could be significant.

Stay tuned for the latest updates on this developing story, as the California housing market faces a pivotal moment that could redefine homeownership in the state.