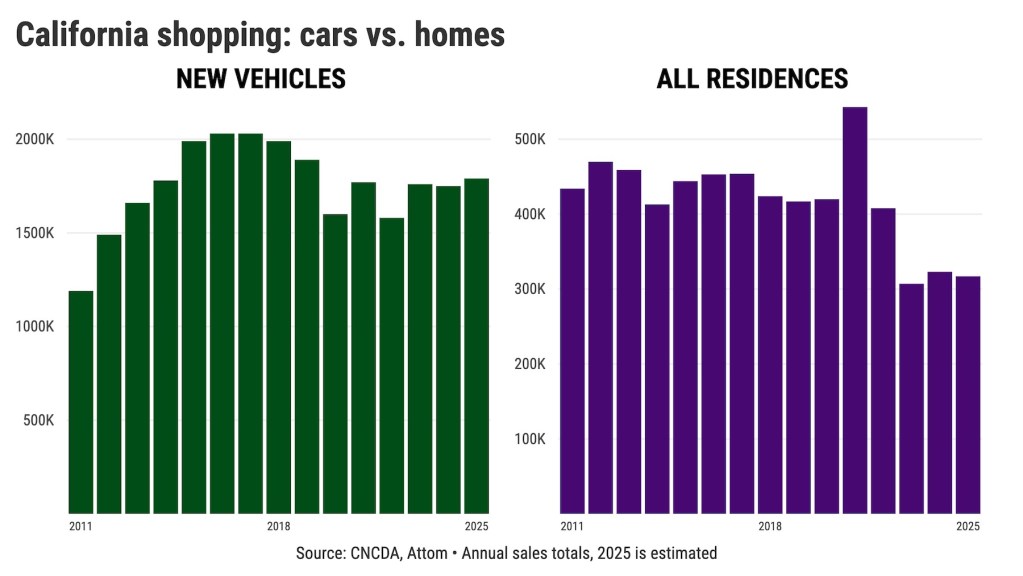

URGENT UPDATE: Californians are showing reluctance to make major purchases as consumer confidence continues to plummet amid economic uncertainty. Latest data reveals that new vehicle sales in California are projected to reach 1.79 million in 2025, marking a meager 2% increase from 2024 after a 1% decline last year. Meanwhile, the housing market is also struggling, with 317,000 residences expected to be sold in 2025, reflecting a 2% drop from the previous year.

The hesitation to buy homes and cars signifies a worrying trend as Californians navigate a wobbly economy. Major investments like these require a sense of economic stability, which consumers are currently lacking. Inflation and stagnant wages are shrinking household budgets, leaving many wary of committing to purchases that historically signal confidence.

According to the California New Car Dealer Association, despite the slight uptick in vehicle sales, current projections remain 12% below the pre-pandemic sales peak of 2.03 million vehicles reached in 2016 and 2017. The situation is even more dire for homebuyers, whose purchases are 42% below the 543,000 homes sold in 2021, a year marked by historically low mortgage rates.

The economic landscape has been further complicated by rising prices. The average new car now exceeds $50,000, and soaring interest rates are making financing more burdensome. Mid-2025 figures show that a typical five-year car loan carries an interest rate of 7.9%, a significant jump from 4.5% in 2022. Similarly, 30-year mortgage rates have climbed to 6.8%, up from 2.9% in 2020, according to Freddie Mac.

John Sackrison, executive director of the Orange County Auto Dealers Association, attributes the sluggishness in vehicle sales to supply chain disruptions from the pandemic, which forced manufacturers to focus on higher-end models to maximize profits. As production levels normalize, consumers remain hesitant to make purchases at inflated prices.

Sackrison notes,

“Uncertainty tends to make consumers pull back.”

This trend is not isolated to California, as national vehicle sales are also declining. The Bureau of Economic Analysis reports that vehicle sales across the U.S. are running at an annual pace of 16.3 million, down 3% from last year.

Similarly, national homebuying is sluggish, with an annual pace of 4 million purchases projected for 2025, also reflecting a 2% drop. This is 11% below the 15-year average and 36% off the peak sales in 2021.

With economic conditions remaining tenuous, experts warn that consumers are likely to continue delaying significant purchases. As Californians reevaluate their financial situations, attention turns to upcoming economic indicators and potential government actions that could influence consumer confidence.

As the landscape evolves, all eyes will be on how these trends impact the broader economy and whether any actionable solutions emerge to ease the financial burdens faced by consumers. Stay tuned for the latest updates on this developing story.