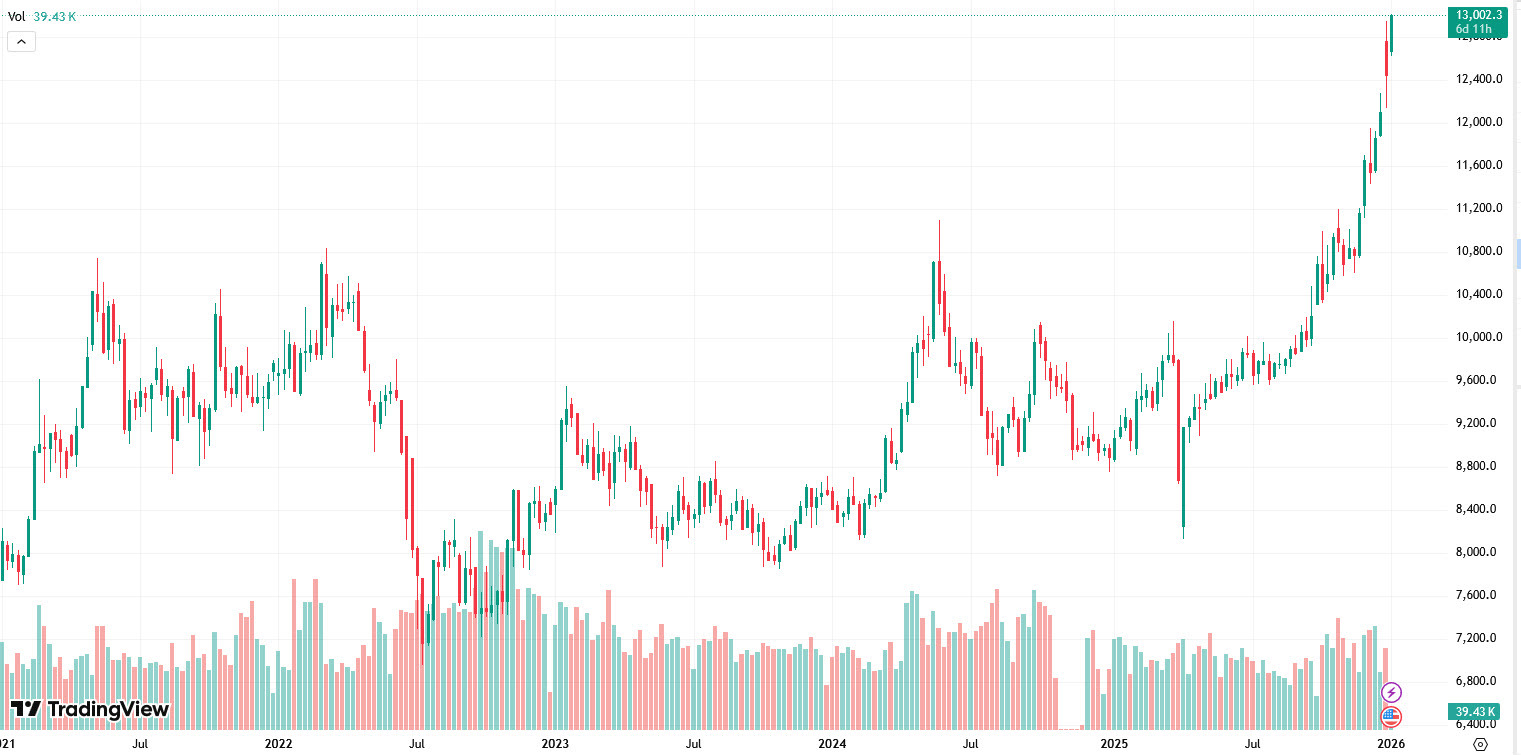

UPDATE: Copper prices have surged to a historic high of $13,000 per ton, marking a critical moment for the global commodities market. This unprecedented spike is fueled by ongoing supply disruptions in Chile, where labor strikes are exacerbating existing supply shortages.

The strike at Capstone Copper’s Mantoverde mine, which began on Friday, is particularly concerning as it has reduced operations to approximately 30% capacity. Around half of the workforce is involved, significantly impacting production levels. This comes at a time when the copper market is already facing critical challenges due to the curtailment of operations at the Grasberg mine, following a tragic mudslide last year.

Experts warn that the labor unrest in the Atacama region could set a precedent for broader labor movements across Chile’s copper sector. With several union contracts due to expire at state-run Codelco, including negotiations around safety and production rates, the potential for further disruption looms large. Current reports anticipate a production loss of 29,000 to 32,000 tons during the strike period, compounding the difficulties faced by the industry.

The global copper market is highly sensitive to these developments. With Grasberg expected to miss approximately 270,000 tons of production this year, the Mantoverde strike adds more pressure to an already tight supply chain. The anticipated gradual resumption of production at Grasberg starting in Q2 could offer some relief, but uncertainties remain.

As negotiations continue at other major mines, including Centinela and Anglo American’s Los Bronces, labor dissatisfaction could spark additional strikes. The potential for widespread unrest highlights a critical moment for copper production in a country that is home to some of the world’s largest copper mines.

In terms of market implications, analysts caution that there are no technical barriers preventing further price increases, with projections suggesting copper could reach as high as $16,000 per ton by 2025. The combination of labor challenges and supply shortages underscores the urgent need for stakeholders to address these issues promptly.

Stay tuned for more updates on this developing story as the copper market reacts to these significant disruptions.