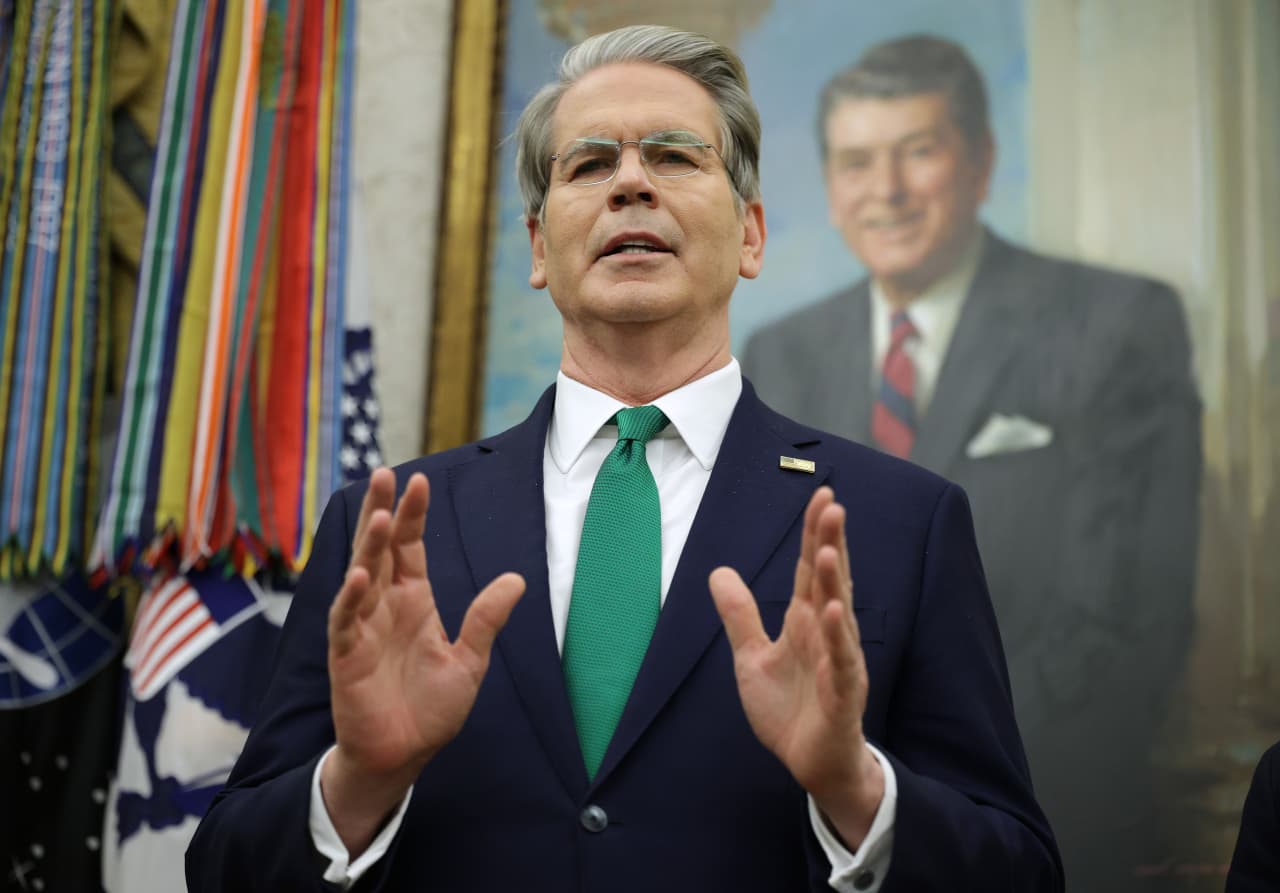

UPDATE: Deutsche Bank CEO Christian Sewing has publicly distanced himself from a controversial analyst report suggesting that European investors might significantly offload U.S. Treasury securities. This urgent announcement comes in light of rising tensions surrounding U.S. fiscal policy and its impact on global markets.

In a statement released just moments ago, Sewing emphasized the importance of maintaining strong relations with key clients, specifically the U.S. Treasury Department. This move highlights the delicate balance Deutsche Bank must strike between internal analysis and external relationships.

The analyst report, which sparked considerable debate, indicated that European investors could potentially sell off as much as $200 billion in Treasury securities in the coming months. This forecast raises alarms about the stability of U.S. debt instruments and their global standing.

Sewing’s remarks come amid heightened scrutiny of the U.S. financial landscape, with international investors closely monitoring the actions of the Federal Reserve and its implications for interest rates. The CEO stated, “We remain committed to our partnerships and will not engage in speculation that could undermine our relationships with critical stakeholders.”

The implications of this situation are profound. Should European investors act on the analyst’s predictions, it could lead to significant fluctuations in U.S. Treasury prices, impacting everything from interest rates to the cost of borrowing for businesses and consumers alike.

As global markets react to this news, all eyes will be on Treasury yields, which have already shown volatility in recent weeks. Market analysts are urging investors to stay informed as developments unfold.

This situation underscores the interconnectedness of international finance and the potential ripple effects that decisions by major banks can have on global economies. With the stakes higher than ever, the response from both Deutsche Bank and U.S. Treasury officials will be crucial in shaping the narrative moving forward.

Investors and stakeholders should keep a close watch on upcoming statements from both Deutsche Bank and U.S. Treasury officials as this situation develops. With immediate implications for the financial landscape, the global community awaits clarity on the future of U.S. Treasury securities and the role of European investors.

Stay tuned for updates as this story continues to evolve.