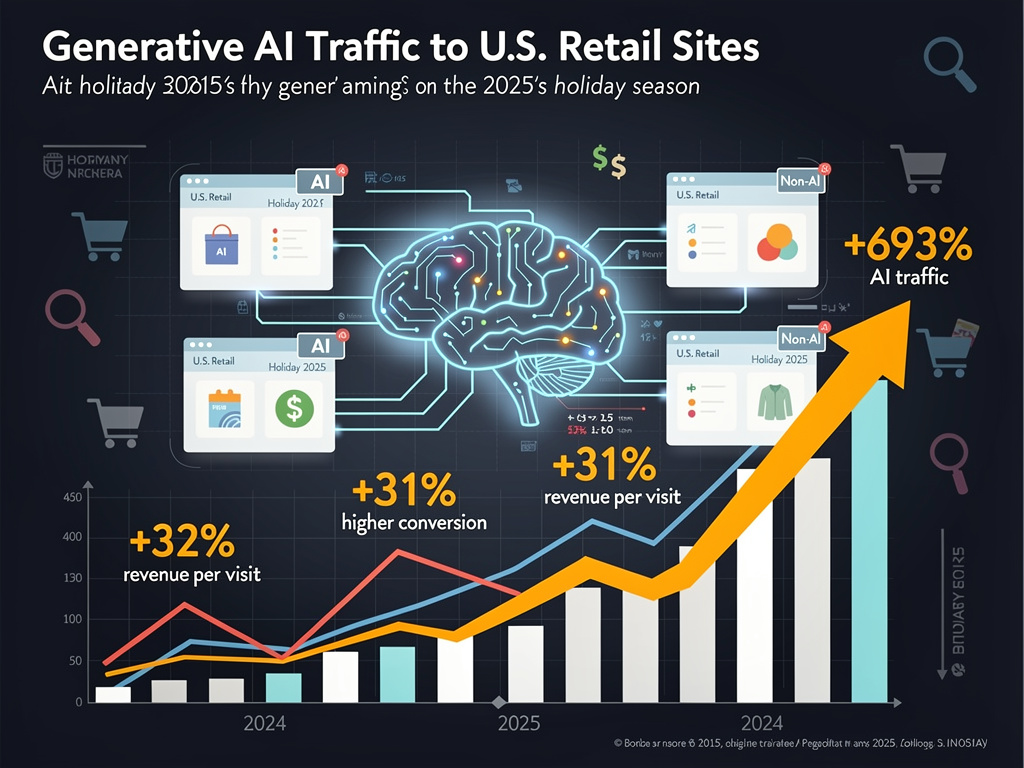

UPDATE: A stunning 693% surge in traffic to U.S. retail sites during the 2025 holiday season has been confirmed, driven by generative AI tools such as ChatGPT, Gemini, and Perplexity. According to Adobe’s latest Quarterly AI Traffic Report, this traffic explosion occurred from November 1 to December 31, marking a pivotal moment in the retail landscape.

The explosive growth in AI-driven website visits is not just a statistical anomaly; it translates to real-world sales impact. Notably, AI referrals converted 31% higher than non-AI sources, with a remarkable 54% increase on Thanksgiving and 38% more on Black Friday. This represents a significant shift from 2024, when non-AI traffic outperformed AI by 51% in revenue per visit.

The retail sector is reaping the rewards as consumers increasingly trust AI recommendations. A survey conducted by Adobe revealed that 47% of shoppers expressed confidence in AI results, indicating a growing acceptance of these technologies. “AI-driven traffic surged across industries, translating into higher conversion rates during the 2025 holiday season,” said Vivek Pandya, director of Adobe Digital Insights.

The implications extend beyond just holiday shopping. AI referral growth soared across various sectors, including travel with a staggering 539% increase, financial services at 266%, and tech/software sectors also experiencing substantial growth. Overall, total U.S. online holiday sales reached a record $257.8 billion, up 6.8% from $241.4 billion in 2024.

As AI tools like ChatGPT and Perplexity gain traction, the landscape of online shopping is changing. Mobile transactions dominated the market, accounting for 56.4% of total sales, peaking at 66.5% on Christmas Day. Additionally, buy-now-pay-later options surged to $20 billion, reflecting a shift in consumer spending habits.

The demographic landscape reveals stark contrasts in AI adoption. High-income states such as Virginia, Washington, New York, California, and Massachusetts generated 52% of U.S. AI traffic, while urban consumers showed 80% awareness of AI assistants. In contrast, rural areas lagged significantly behind in both awareness and usage.

Despite the positive trends, challenges remain. High return rates at 28% pose pressure on profit margins, and a digital divide exists in AI commerce uptake, with some areas like Mississippi showing high online activity but low engagement with AI tools. Nevertheless, only 2% of consumers are unaware of AI assistants, indicating a rapid shift in consumer behavior.

Looking ahead, 58% of consumers are planning to incorporate more AI shopping into their routines for 2026, highlighting the urgency for retailers to adapt. “For retailers and brands, this signals a lasting shift in how consumers discover and evaluate products,” Pandya noted, emphasizing the need for marketers to pivot their strategies.

In closing, the data from Adobe, derived from over 215 top retailers, shows that optimization for AI-driven traffic is essential. As AI continues to shape consumer behavior, retailers who ignore this trend risk obsolescence. The era of AI assistants in retail is not just on the horizon; it has arrived, and adapting to this new reality is critical for future success.