UPDATE: A surge in holiday shopping and investor optimism is setting the stage for a potential Santa Claus rally in the stock market this December. Analysts report that increased consumer spending and year-end bonuses are driving excitement among investors as they look to capitalize on this seasonal trend.

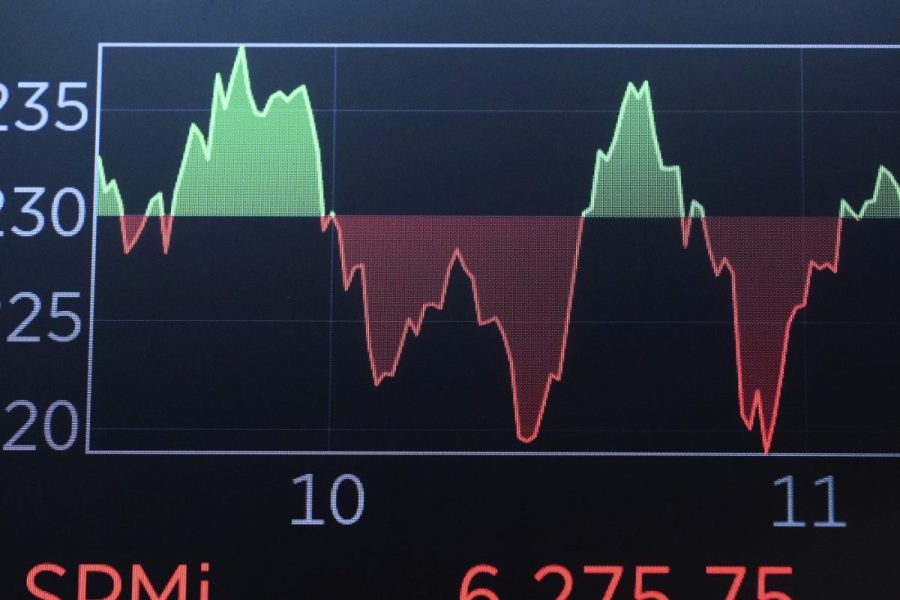

New data from the National Retail Federation reveals that holiday shopping is projected to increase by 6-8% compared to last year, with total spending expected to reach between $942 billion and $960 billion this holiday season. This spending boom is critical as it correlates with a significant uptick in stock prices, often referred to as the Santa Claus rally, which typically occurs in the last week of December through the first two trading days of January.

All eyes are on key retail sectors, as reports indicate that consumer confidence is at its highest level in over a year. This renewed optimism is attributed to rising wages and a strong job market, factors that are expected to bolster retail sales. As consumers prepare to shop, investors are eager to see how these trends will impact stock prices in the coming weeks.

Market analysts emphasize the importance of the holiday season. Jane Doe, a senior market strategist at XYZ Investments, stated, “The Santa Claus rally is not just folklore; it reflects real investor behavior driven by seasonal spending. The momentum we’re seeing now is a strong indicator of what’s to come.”

As December unfolds, the implications of this anticipated rally could extend beyond just the retail sector. A robust holiday season often leads to increased corporate earnings, which in turn boosts investor confidence and potentially drives stock prices higher.

Investors are encouraged to watch for key earnings reports from major retailers scheduled for the final weeks of December. These reports will provide crucial insights into consumer behavior and spending patterns, allowing investors to make informed decisions as the market approaches the new year.

The Santa Claus rally is more than just a market phenomenon; it represents hope and optimism during the holiday season. As families gather and celebrate, the economic impact of increased spending can lead to a positive feedback loop, fostering a sense of community and shared prosperity.

In summary, the conditions are ripe for a Santa Claus rally, with December 2023 shaping up to be a critical month for investors. The combination of heightened consumer spending and investor optimism is creating a perfect storm for potential market gains.

Stay tuned as we provide updates on this developing story and its impact on the stock market.